7 Ways To Manage Financial Stress During Trying Times

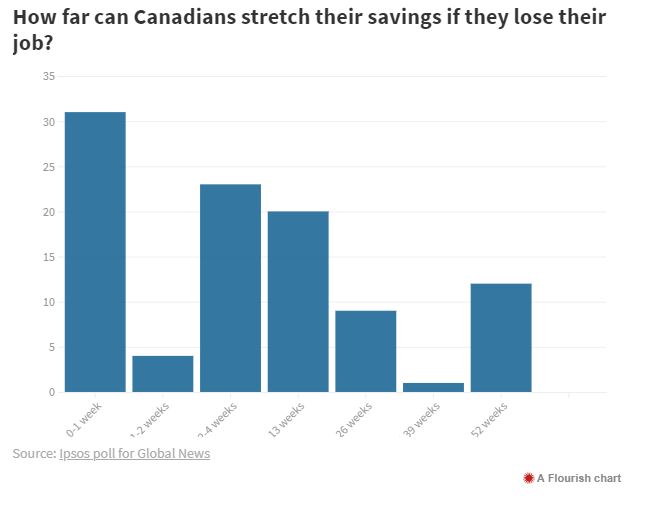

The year 2020 has been eventful to say the least. If you haven’t been directly affected financially by the economic disruption, there’s a decent chance you know someone who has. Considering the current unemployment rate, shutdowns, and rising federal debt, it’s understandable that you may be feeling stressed about your finances. It may even be causing you to lose sleep. Here are some ways that you can manage your financial stress during trying times.